If you see old items, you need to investigate why they are still there. Perhaps you forgot to record a prior deposit or the check was lost and never deposited. For more detailed instructions, head to our tutorial on how to receive payments in QuickBooks Online. If you want to avoid seeing the JE from appearing when making a deposit, you can transfer the amount in the Undeposited Funds account to a designated account. You can create a Journal Entry, debit the Undeposited Funds account, and credit the designated account. You should seek guidance from your accountant to determine which account to create or use.

Fintechs and Traditional Banks: Navigating the Future of Financial Services

In this comprehensive guide, we’ll walk you through the process of cleaning up undeposited funds in QuickBooks Online, as well as how to clear, fix, get rid of, and delete undeposited funds. We’ll also cover how to clear undeposited funds in QuickBooks Desktop and how to turn off undeposited funds in QuickBooks Online. Undeposited Funds is simply a holding account that tracks payments received from customers that have not been deposited into your bank account. Once you have your deposit slip, make a bank deposit in QuickBooks so that payments in Undeposited Funds will match up.

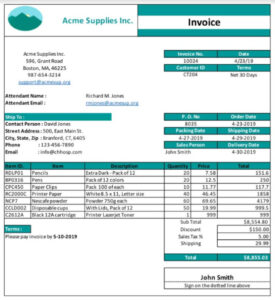

Invoice payments you process outside of QuickBooks:

It is crucial to maintain a clear trail of documentation to support the deletion, such as notes detailing the reason for the adjustment and any approvals required. Transparency is key, and any changes made should be well-documented and easily traceable. Fixing undeposited funds in QuickBooks Online requires a systematic https://www.quick-bookkeeping.net/gross-pay-vs-net-pay/ approach to identify and resolve any discrepancies or issues related to pending payments and deposits. Next, select the account to which the funds will be deposited and add the payments to the deposit. Make sure to verify the details and allocate the funds to the appropriate income or expense accounts.

What is the Main Purpose of Undeposited Funds Account in QuickBooks?

Well, get ready to learn something new and take a thorough look at Undeposited Funds. For a tutorial on how to use this account, we have put together a step-by-step instruction guide. While you are most likely familiar with the navigation system of QuickBooks, it may be difficult to find new accounts, especially if the system has been set up by someone other than yourself.

Step 3: Match Deposits to Invoices and Payments

Rather, You just add it to any income account from the particular banking sector of your QuickBooks account. I am trying to clear up some items listed on my balance sheet has “undeposited funds”. But when I look they have been deposited and cleared on previous bank statements. Therefore, it’s crucial for businesses to diligently record all deposits to maintain the integrity and precision of their financial records. QuickBooks moves the money from Undeposited Funds into your bank account, just like your actual bank deposit.

Step 5: Review and Finalize the Bank Deposit

You just learned how to use the Undeposited Funds account in QuickBooks Online, its importance, and when to use it. If you want other free resources to learn how to better use QuickBooks for your business, check out our free QuickBooks Online tutorials. If you need to delete a bank deposit, click the deposit or amount field in the Deposit Detail report and then click More at the lower part of the screen and then select Delete as shown below. When you scroll down the Sales receipt form, you’ll see additional sections, including information about the product purchased by the customer or service rendered.

Clearing undeposited funds in QuickBooks Online is a vital task to ensure the accuracy and integrity of your financial records. By understanding how undeposited funds work and following the step-by-step process outlined in this guide, you can confidently manage and clear undeposited funds in your QuickBooks Online account. When you’re ready to clear undeposited funds, you will create a new bank deposit in QuickBooks Online. Before creating a new bank deposit, review your undeposited funds account and organize the transactions within it. This step ensures that all the payments you want to clear are accounted for and properly classified.

- Undeposited Funds is simply a holding account that tracks payments received from customers that have not been deposited into your bank account.

- Looking for intuitive and simple workflows to satisfy your accounting needs?

- If it’s still the same, I’d suggest contacting QuickBooks Care team.

If you’re depositing your checks one at a time, which is often the case for smaller businesses, you have to keep careful track of each and every deposit. However, when you use the undeposited funds account, you can record the specific checks in your software and not have to come back to them later to find out which is which. Remember, it’s essential to regularly review, organize, and reconcile your financial records to ensure their accuracy and integrity. If you encounter any discrepancies or have specific questions, consult with a professional accountant or refer to the QuickBooks Online resources for further guidance. If all the payments were successfully included in the bank deposit and cleared, you should observe a zero or near-zero balance in the undeposited funds account.

By doing the steps above, you’d be able to deposit your customer’s future payments directly to the correct checking account. Taking prompt action to rectify these discrepancies is essential to maintain financial integrity and ensure a clear and the cost of goods manufactured schedule accurate representation of the company’s financial status. You can make sure your financial data are accurate by pulling up the Reconciliation report. This will also let you access your individual reconciliation reports and check their accuracy.

In this guide, we will walk you through the steps to clear undeposited funds in QuickBooks Online. We will explain the concept of undeposited funds and why it is important to clear them. We’ll also provide you with a step-by-step process to help you confidently clear undeposited funds in your QuickBooks Online account. We’ll have to delete the deposit and use the pending one on the undeposited funds. In this particular Remove and Record process, any transaction that is uncategorized with cash inflow is overturned in QuickBooks. It assists in clearing the particular undeposited funds in the QuickBooks software.

Please note to back up your company file before doing any troubleshooting to have a save point. The process described in the previous section repeats for as many sales receipts as needed. The payments you collect from the customers go to Undeposited Funds. Finally, you can see the number of payments in Undeposited Funds on the Record Deposits icon.

Not recording all deposits can lead to an imbalance between the actual and reported funds, affecting financial statements. Duplicating deposit entries can result in overstated revenues, leading to incorrect financial metrics and potential compliance issues. Irregular or infrequent reconciliation can create discrepancies that may snowball into larger financial discrepancies over time, making it challenging to identify and rectify the root cause of errors. To begin, access the Banking menu in QuickBooks and select Make Deposits. Then, locate the undeposited funds account and ensure that all payments are properly matched and deposited into the appropriate bank account. It’s important to review each transaction carefully to avoid any discrepancies.

Undeposited funds are a convenient feature in QuickBooks Online that allows you to group together multiple payments before recording a bank deposit. This gives you better control over your cash flow and streamlines your bookkeeping process. However, it’s important to regularly clear undeposited funds to ensure that your records are accurate and up to date. This level of attention to detail ensures that all deposits are accurately reflected in the undeposited funds account. It is vital to record each deposit promptly and precisely to avoid discrepancies.

I appreciate you joining the thread with your bank feed inquiry, Sarah. Let’s find out why https://www.business-accounting.net/ the Deposit to option isn’t showing up on your customer payment in QuickBooks Desktop.